Cash App is redefining the world’s relationship with money by making it more relatable, instantly available, and universally accessible. As a Content Manager on the Internal Communications team, I built programs and content to help employees understand our mission, feel inspired by it, and align their work to the bigger picture.

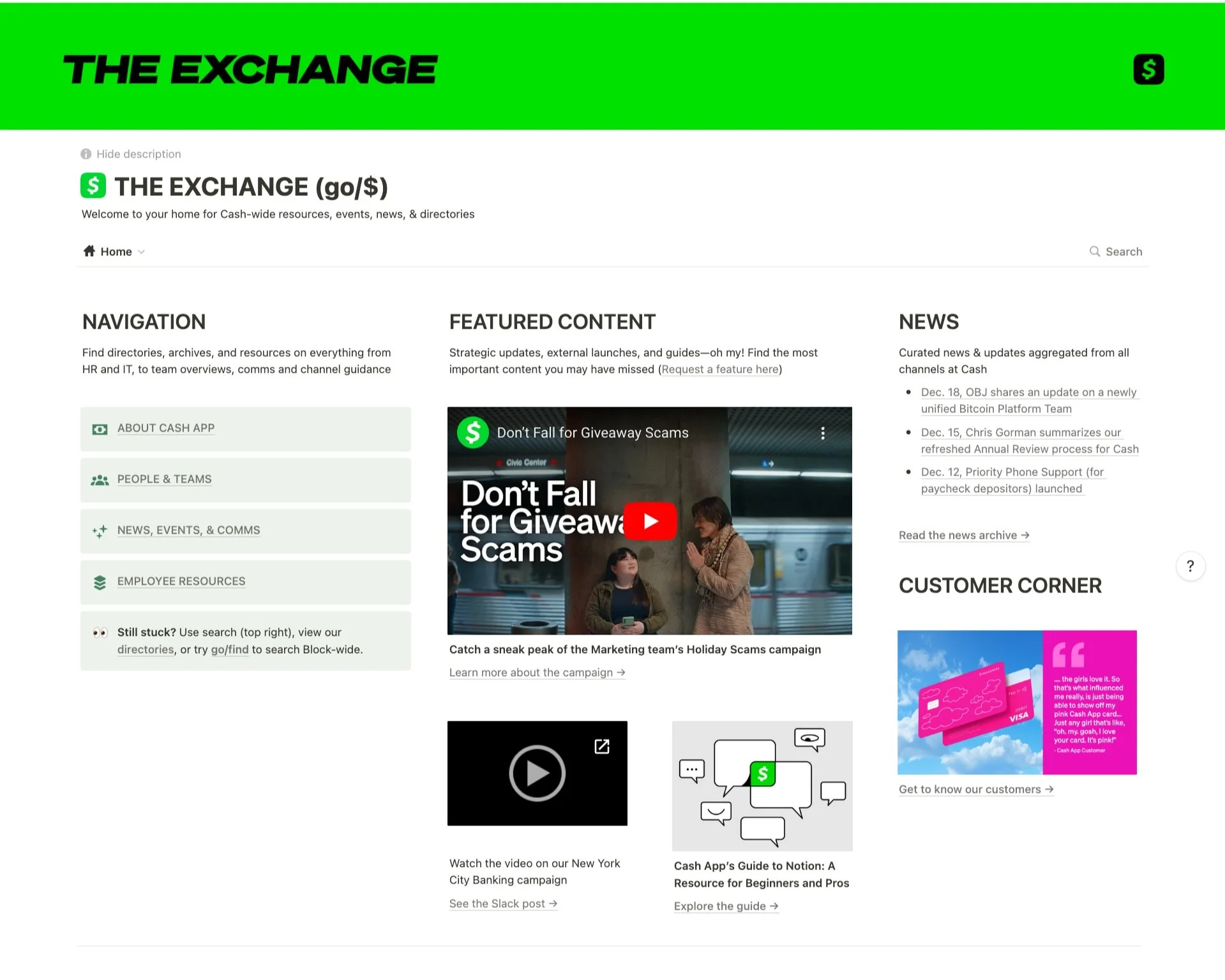

The Exchange: Cash App’s intranet

Cash App had roughly 6 disparate systems containing information. Employees had no idea what was up-to-date, or where to find what mattered. To help, I coordinated a massive cross-functional team to launch The Exchange, built on Notion. Through user testing, I iterated on the content to ensure we prioritized what employees wanted most. Since launch in November 2023, The Exchange and its resources have reached nearly 75% of employees, many of whom are repeat users.

Survey: Gauging company-wide internal communications sentiment

With help from our Customer Insights team, I pitched and ran Cash App’s first-ever sentiment survey on Internal Communications. This included drafting, socializing, and analyzing it. The survey was sent to a representative sample of employees (496) from every team across the globe, and the insights gleaned informed our team strategy for 2023 and 2024.

Cash App, Explained: Live events that unpack complex topics

I launched Cash App, Explained, a quarterly event series, to ensure employees worldwide have a shared understanding of important, but complex topics. Because of the program’s success, it was transformed into “Block, Explained” covering topics across Cash App, Square, Afterpay, and TIDAL. To run the program, I partnered with subject matter experts across the business to translate their expertise into presentations that employees—regardless of their role or team—can understand. Besides offering key context on how these topics work in real life, Explained emphasized moments of fun and delight—and it paid off. While attendance for live events typically averages at 5-10%, Explained presentations have garnered anywhere from 15-25% company-wide attendance with an NPS score of 70+ every time (industry average = 50).

Content Enablement

Empowering people to use Cash App’s voice

No matter the team, employees at Cash are encouraged to share their work — but knowing the best way to explain it can be tough. I created this writing guide to enable folks to talk about their work in a way that aligns with our voice principles: upfront, approachable, to-the-point, and human.

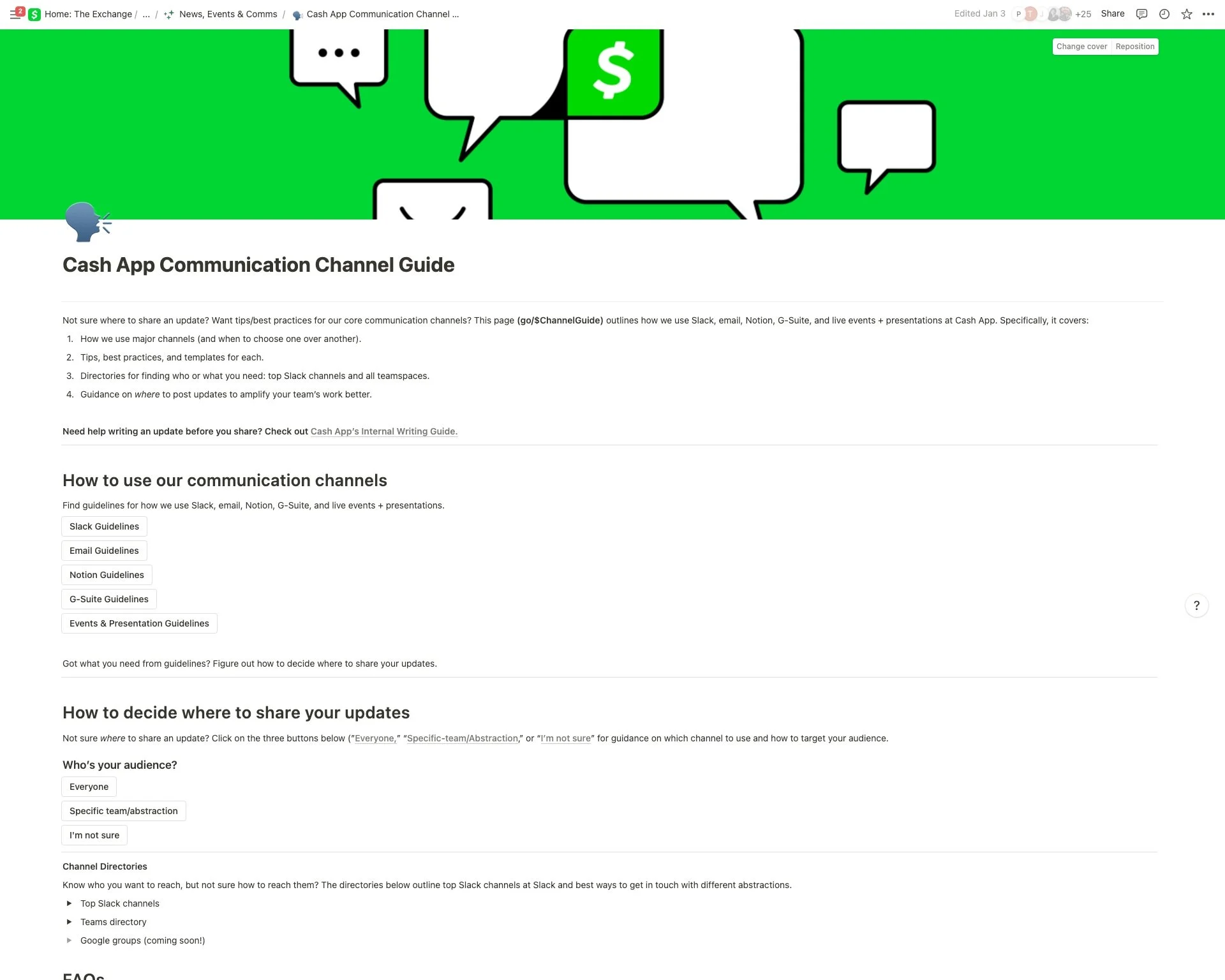

Enabling people to share their work in the right places

Cash App has grown fast. Because of this, internal tools and systems got noisy. Employees feel frustrated they don’t know who to connect to, when, and where. To help, I created a channel guide (complete with decision tree) to help folks cut through the noise and understand the best way to share their work with the right people in the right places.

Writing samples

-

Block reported Q3 earnings on November 2, Jack and Amrita covered a lot of ground. Before diving in, we want to acknowledge yesterday’s news about the cap and echo Jack’s words: we know what was shared may cause people to feel anxiety and unsettled for some time. As always, the goal of this newsletter is to help you stay informed on our business performance through the curation of key themes, financial highlights, and coverage from the Q3 report.

Key Themes

Rule of 40 by 2026. Jack shared that he believes Block will achieve Rule of 40 in 2026, driven by a combination of growth and profitability initiatives. We also reinstated formal guidance and previewed profitability in 2024, which is expected to improve compared to 2023. Read the shareholder letter for more detail and watch next week’s recording of Alex Anderson, Cash App’s F&S Lead, who will provide Cash-specific context on our Q3 performance.

Implementing a headcount cap. In yesterday's shareholder letter, Jack announced that Block will be “creating an absolute cap on the number of people we have at the company, held firm at 12,000 people until we feel the growth of the business has meaningfully outpaced the growth of the company.” For more information, see Jack’s internal note, and for details on how Cash App will approach this cap, please see Brian’s note.

Focus on primary banking. We shared that Cash App has a focused strategy on earning the primary banking relationship of our existing customer base in the US. Key supporting work streams we called out included continued focus on reliability, customer service, security, enhancing our banking feature set, and revisiting the positioning and packaging of Cash App’s financial services offerings.

Cash App Card as an entrypoint. We have seen customers adopt the card and then expand usage to other financial services products within Cash App like Savings, ATMs, Borrow, and Direct Deposit. Cash App Card reached 22 million monthly actives as of September, with approximately 30% of those transacting on any given day.

Notable Numbers

$984 Million: Cash App’s Q3 gross profit, up 27% year-over-year (YoY)

62 Billion: Overall inflows during Q3, up 21% YoY and 1% quarter over quarter

55 Million: Number of monthly transacting active customers, up 11% YoY

$1,132: Inflows per transacting active, up 8% YoY

1.43%: Monetization rate, up 8 basis points YoY

2 Million: Number of Cash App Borrow monthly actives as of September generating $1.4 billion in annualized volumes, both doubling since June

In the News

Media coverage focused on how Block’s Q3 earnings beat led to a strong stock reaction partially fueled by Cash App’s revenue and user growth. Specifically, the media focused on Borrow, which generated $900 million in short-term loans during Q3. Plus, the crypto trades honed in on Block’s bitcoin revenue and gross profit increase driven by Cash App.

Select Media Coverage

Bloomberg: Block Soars on Boosted Profit Outlook as Cash App Grows

Fortune: Block’s Bitcoin revenue grew nearly 40% while value of its Bitcoin holdings rose

Barron’s: Block Reaches ‘Turning Point’ for Efficiency. It Joins PayPal in Payment Stocks Rally.

CNBC: Block shares surge after earnings beat and increased full-year guidance

-

Internally, our writing is always grounded in the below principles so that no matter who’s writing (or where), we sound consistent.

Upfront: We tell it like it is in service of helping people do their best work. We set clear expectations for outcomes, what’s in progress, to-dos, and due dates. We build trust through transparency about what we do/don’t know, can/can’t share or achieve.

Approachable: Our conversational style makes us relatable. We make things accessible and simple. **Simple doesn’t mean dumbing it down.** It *does* mean finding the clearest way to explain complex things so all the smart people at Cash–whether they’re on your team or not–know what you mean. We don’t hide behind corporate speak or inauthentic plays to emotion.

To-the-point: We explain what people *need* to know and why they should care, quickly. This means being mindful of your audience’s capacity to absorb information. So we prioritize what’s most important and make additional details accessible via links. We instill confidence by giving employees the info, tools, and context they need (but briefly so they can digest it on their own terms).

Human: We want you to feel authentic when you communicate. In more sensitive contexts, this may look like offering empathy, or sharing your own reaction to a situation. In celebratory situations, this may mean leaning into personality–using emojis, shouting out your team, or telling a quick story to make a point (oh! That reminds me about a time when… you get it).

-

Hi team! Since 2013, we’ve gone from 0 to over 53 million active customers. But who are our customers, really? How do they use our products? How can we empathize with them? Our Customers, Explained has the answers.

What: A LIVE presentation that’ll cover our growth story, who our customers are, why our network is so valuable to them, and what stops customers and non-customers from using Cash App.

Why: Customers are the thread that unite all of our teams. They’re the basis for how we make decisions and prioritize work, and understanding them means connecting more deeply with our mission.

Who: Hosted by our Head of Customer Insights), Marketing Insights Researcher), Voice of the Customer Specialist). Editorial Manager) will facilitate.

When: October 4 at 12:05pm PST / 3:05pm EST. Can’t make it? We'll share the recording via go/$Customers and go/$Explained.

Bring your questions. Bring your trivia a-game. Bring a colleague. Can’t wait to see you there!

-

Money — and the cards we use to spend it — are central to our lives. At Cash, we believe that cards should fit your kit. The Pink Card proved it and our customers believe it, too. And now the Glitter Card is showing us the same. But the Glitter Card is SO much more than just a pretty piece of plastic. It represents a massive, two-year cross-functional effort to help our customers feel seen and self-express. TL;DR this article covers what inspired the Glitter Card, how Cash App Cards are made, behind-the-scenes facts from teams responsible for the sparkle, and launch metrics (as they become available).

How it started

Bringing Glitter to life took over two years, and its origin story might surprise you. It started with Jane Lim (Industrial Designer on the Hardware Design team) looking for inspiration everywhere and anywhere, “Finding ideas for future-facing Cash App Cards isn’t linear. I do a deep internet scour — I look at fashion shows, what celebrities are wearing, and other trends. Pulled a lot of inspiration from past eras, too. I’m in Tumblrs, Instagram, and all over social. I look for material references, this can include colors, photography, or editorial. In the end, I presented a deck with over 50 card ideas. Pink and glitter were the two we moved forward with.”

Amie Miller (Issuing Lead for Financial Operations) explains how the vendor process works, “It's my team’s role to then go to our manufacturers and get them to dream with us. Especially since we don't want to build just navy blue or red cards, and that’s the standard. I challenge them with questions like, “Could we build a card out of this material? Could we use a card you've never seen before?”

Amie describes the manufacturers’ reactions to putting glitter inside of a card, “We got an immediate no. But it’s just about keeping the vendors working on it until one makes a sample closest to our vision.” In fact, the process between Cash App and our manufactures is quite involved. Financial Operations and Industrial Design meet with them on a weekly basis while innovating on a card. And bringing a card to life from concept to launch can take anywhere from 12-to-18 months. While manufacturing continues, Marketing and Brand Creative get involved once samples are ready.

Did you know? The Glitter Card has real glitter flecks inside of it. It’s also fully transparent, and you can see the card’s antennae running through.

Developing the Glitter concept

Thinking about the card’s objectives and audience were key focuses for Valentina Diaz Delgado (Product Marketing Manager) when she began work on the Glitter project in early 2023, “When I’m pulled in, I start by thinking about what we’re going do with this card, what’s our goal? And you can’t build a go-to-market plan until you know who you’re building it for. So with help from the Customer Insights team, we built our target audience. We researched trends. We realized that glitter is used when people want to self-express, or make everything feel better, which helped guide our concept and target audience. Based on this, we decide what channels to use, and what story to tell. Overall, what we want to achieve across most card launches has converged: sell cards and lift awareness.”

In addition to an audience profile from Customer Insights, learnings from our Pink Card campaign shaped the story. Allison Supron (Brand Creative Lead) shares how one campaign impacted the other, “One of our biggest learnings from the Pink campaign was using some channels to build the world, and others showcase the technical features. Specifically, we want to create hype, excitement, and awareness for the card on upon launch, and use growth-specific channels to highlight the card benefits. Glitter is so exciting and joyful; the team wanted to create a world inside our campaign that highlighted that. The Glitter Card creates unadulterated joy and self expression to those that experience it.”

Marketing and Product collaborate

While the story was being developed, Marketing worked with Product to conceptualize how the card would show up in the app. This meant making sure the material looks the same in person as it does virtually, ensuring the messaging for Glitter is consistent wherever you are in the app, setting up a Glitter-themed personalized payments screen, and more. PR and Comms also play a huge role in the process, too. Due to the hard work of our Partnerships Marketing team, we secured Keke Palmer as the face of the Glitter Card campaign. Internal reviews and employee beta testing happened throughout. Allison explains the importance of internal reviews ahead of a launch, “This campaign is a prime example of cross-functional team collaboration. From building an AR TikTok filter with the social team to the partnerships team working with talent, there’s just so many people that need to be there and involved.”

Getting cards to our customers

As the Cash team introduces Glitter to the world, the Financial Ops team works with our manufacturers to ship the cards. Did you know that some card manufacturers are also secure personalization bureaus? While manufactures create the cards, these facilities do everything from executing customers’ unique designs to putting $cashtags on cards to ensuring specific card numbers are paired with the right customer data. Outside of launches, the personalization facilities may get up to 50,000 requests from Cash App a day. As for a launch like Glitter, the card volume is much bigger — 2 million in the warehouse and a million on order. Why so many? Past success. The Pink Card, sold roughly 500,000 units within 10 days of launch and eventually sold out.

Did you know? Card manufacturers and personalization facilities take security seriously. In addition to being secured for brands like Visa, MasterCard, and American Express, these facilities are government and health care-secured, too. In other words, Cash App Cards are made at the same place that your medical cards, government IDs, driver's licenses are.

What’s next

The end of a launch doesn’t mean the work stops. We’re on a mission to keep creating magical moments for our customers (in service of Banking our Base). Anna Thompson, Product Manager for the Cash App Card, explains how this worked for the Glitter launch in particular, “The Glitter launch was a huge step in strengthening the connection between our software (the app) and hardware (the physical card) experiences that are completely unparalleled in the market today. Customers can interact with a 3D model of the Glitter Card in app and truly feel the experience of the card before ever seeing it in real life. Glitter Personalized Payments were big, too. Personalized Payments only launched a few months back, and we are excited to continue connecting a card's aesthetic directly to the P2P experience in order to supercharge those network effects.”

Have questions on the product or campaign? Reach out to the team via #cash-lifestyle-capsule-glitter.This article will be updated with Glitter Card campaign metrics as they become available.